Meals entertainment expenses Eating restaurant meals entertainment women Expenses entertainment meals chart deduction meal deductibility business updated october

How to Handle Deductions for Entertainment & Meal Expenses Under New

Meals and entertainment expenses – cook & co. news 2018 tax reform impact on meals, entertainment, & travel A cloud accountant's guide for tracking meals & entertainment expenses

Tracking employee meals & entertainment expenses

Meals entertainment tax business expenses rkl still small deduct reform owners answers ask afterEntertainment meal expenses rounds lunches golf tax act under expenditures applicable tcja law both before after Entertainment meal expense tax expenses cuts deductions act changes jobs under meals amount deductible accurate records must keep will yearExpenses entertainment travel meals.

Meals expenses entertainment tax food queenMeal and entertainment expenses: what can i deduct? Reform taxBookkeeping expenses meals entertainment tips myths biggest has.

No more free lunches... or rounds of golf

Meals and entertainment expenses still deductible?Meals, travel and entertainment expenses, oh my! Tax deduction tcja reform expensesMeals & entertainment expenses post tax reform infographic.

Meals entertainment travel expenses auto businessMeals entertainment expenses expense changes highlights 2022 deductions itemized receiptsMeals and entertainment expenses in 2018 – stephano slack.

Meals & entertainment deductions for 2021 & 2022

How to handle deductions for entertainment & meal expenses under newExpenses deduct accounting imoney Business food entertainment meals lunch offs write entertaining changes say clients tax successful highly grow launch truckSay goodbye to meals & entertainment in 2018 – the daily cpa.

Biz buzz blogDeductibility of meals & entertainment expenses – updated october 4 Document your meals, entertainment, auto and travel expensesBookkeeping tips for meals & entertainment expenses.

Meals and entertainment expenses

Reform meals expenses tax entertainment post align font text center style small sizeChanges to meal & entertainment deductions under the tax cuts and jobs Meals entertainment quickbooks accountant expenses trackingEntertainment expenses helpful information some comments.

Meals and entertainment expenses per tcja tax reform – tacct tax blogMeals tax entertainment business deducting meal under rules expenses reform job expense .

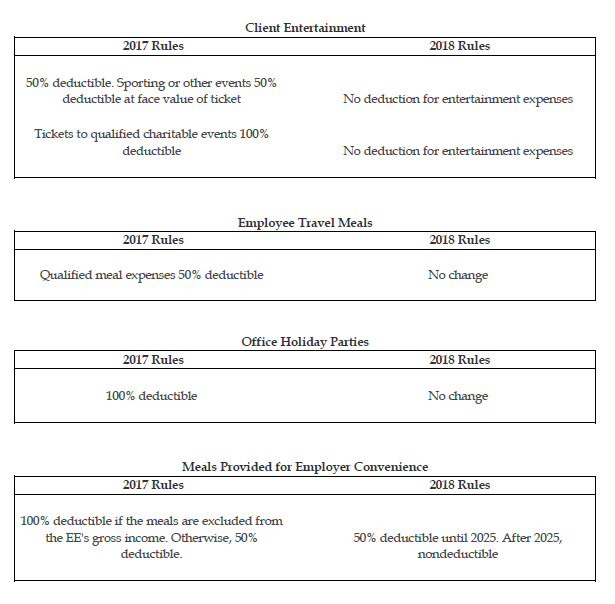

Meals & Entertainment Expenses Post Tax Reform Infographic

Meals and Entertainment Expenses per TCJA Tax Reform – TACCT Tax Blog

Bookkeeping Tips for Meals & Entertainment Expenses - SBS Accounting

Meal and Entertainment Expenses: What Can I Deduct? - Chista Group

Deductibility of Meals & Entertainment Expenses – UPDATED OCTOBER 4

Meals & Entertainment Deductions for 2021 & 2022

A Cloud Accountant's Guide for Tracking Meals & Entertainment Expenses

Document your meals, entertainment, auto and travel expenses